Trading Algorithms: Areas of Concern

Trading Algorithms: Areas of Concern

Lack of Visibility

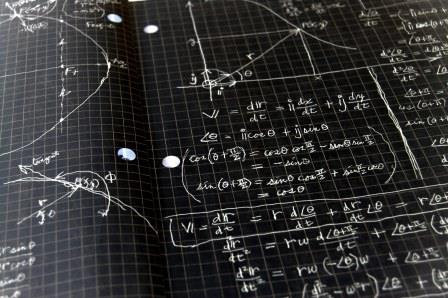

We know what a specific algorithm is supposed to do, measure its pre-trade analytics and see how the post-trade results match up to that expectation. But if the trader didn’t select the most optimal algorithm for that trade little can be done. This problem is caused by a lack of visibility and transparency into the algorithm while it is executing orders.Algorithms Acting on Other Algorithms

If fund managers trading pattern is spotted and regular; tracked with the use of algorithms, then these algorithms are liable to be ‘reverse engineered’. This implies that their buy and sell orders are pre-empted and used to the maximum effect by their competitors. Here, algorithms are acting on other algorithms.Which Algorithm to Use for Trading?

With brokers offering many algorithmic strategies, one concern is that buy-side institutions lack the tools to understand which algorithm to use for a particular stock. The lack of a standard benchmark has made it almost impossible to assess the quality of algorithms. Buy-side firms are having a hard time evaluating when to use a particular algorithm. For example, if a portfolio manager tells a trader to sell a mid-cap, semi illiquid stock within five hours because the manager has to raise cash, the trader may be confused about which algorithm would be the best solution, given the constraints on liquidity and time. They need a certain level of sophistication and understanding to use it.Algorithmic trading requires careful real-time performance monitoring as well as pre and post-trade analysis to ensure it is properly applied. Traders must calibrate the algorithms to suit portfolio strategy. Far from the sole or final answer to best execution, algorithmic trading represents an additional tool in a trader’s expanding kit. Far more important is aligning execution choices with the level of order difficulty involved in terms of: order size, liquidity, and trade urgency. Low touch venues such as algorithmic trading lend themselves best to easier types of orders such as low urgency and small orders for large cap stocks. But urgent orders for a large volume of small cap stocks would require a higher touch approach to ensure best execution and cost efficiency.

Missing Ingredient in the Trader’s toolbox

Algorithms are simply advanced trading tools and they cannot replace the human elements or make interaction redundant. Algorithms fail to capture a trader’s “gut feelings”. It is the intraday trading characteristics of a stock that assist a trader in determining the right strategy, whether to back off or be more aggressive. In order to allow their guts to play a proper role, the traders need to see precisely what actions their algorithms are taking, what venue the orders are being sent to, and where they get filled. It is early in the development of trading software to think that the thought process of a human trader can be mimicked by an algorithm. Algorithms can not compete with the ability of the human brain to react to unanticipated changes and opportunities. Some algorithm providers are trying to addressing this issue by offering instant messaging (IM) services that work with the algorithm. As trades go on, a trader is alerted of issues that arise and the trader can alter the strategy depending on the nature of news.At the end of the day, it’s the clients who drive the demand and innovation necessitating next generation algorithms. The next generation of algorithms will be able to “speak” to the trader, to let the trader know what is going on dynamically, and allow the trader to interact with the algorithm. Soon we will have adaptive algorithms that adjust their execution at each moment in time in response to what they see happening in the market just as a human trader.

Nice Article. This post is helpful to many people. Stock Investor provides the latest Indian stock market news and Live BSE/NSE Sensex & Nifty updates. Find the relevant updates regarding Buy & Sell...

ReplyDeleteforex broker

national currency